Critical Illness Insurance: Do You Really Need It?

Medical emergencies are unpredictable and can have a major financial impact on individuals and families. While standard health insurance covers hospitalization costs, it may not fully protect against the long-term financial burden of a critical illness. This is where critical illness insurance comes into play. But is it really necessary? Let’s break it down.

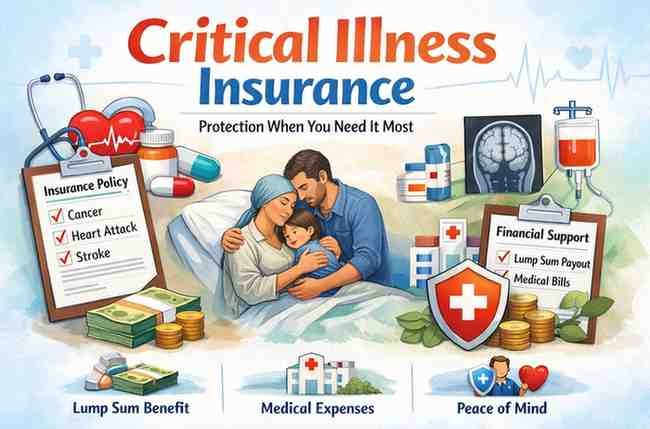

1. What is Critical Illness Insurance?

Critical illness insurance is a specialized health policy that provides a lump-sum payout if the policyholder is diagnosed with a covered serious illness. Unlike regular health insurance:

-

The payout is fixed, not linked to hospital bills.

-

It can be used freely — for treatment, rehabilitation, or personal expenses.

-

Commonly covered illnesses include cancer, heart attack, stroke, kidney failure, and major organ transplants.

💡 Tip: Policies may vary, so carefully check the list of covered illnesses.

2. Why Standard Health Insurance May Not Be Enough

Health insurance typically reimburses hospital and treatment expenses. However, critical illnesses often lead to additional costs not covered by standard plans:

-

Loss of income due to inability to work

-

Rehabilitation and therapy costs

-

Long-term care or home modifications

-

Travel and lifestyle adjustments for treatment

A lump-sum critical illness payout can bridge these financial gaps, providing flexibility and security.

3. Benefits of Critical Illness Insurance

-

Financial Security: A lump-sum payout helps cover medical bills and daily expenses.

-

Income Protection: Supports you and your family during recovery periods when earning capacity may be reduced.

-

Freedom of Choice: Payout can be used for treatment, alternate therapies, or even debt repayment.

-

Peace of Mind: Reduces stress, allowing focus on recovery rather than finances.

💡 Pro Tip: Even if you have health insurance, a critical illness policy ensures extra protection against major financial setbacks.

4. Who Should Consider Critical Illness Insurance?

Critical illness insurance may be particularly important for:

-

Working Professionals: To secure income during long treatment periods.

-

Parents with Dependents: Protect family finances in case of sudden illness.

-

Individuals with Family History of Illnesses: Those at higher risk of hereditary diseases.

-

Freelancers and Small Business Owners: Lack employer-provided coverage or sick leave benefits.

If you are young, healthy, and financially independent, you may opt for lower coverage, but early enrollment usually means lower premiums.

5. How to Choose the Right Policy

-

Coverage Amount: Consider a sum sufficient to cover treatment costs and living expenses (₹20–50 lakh is common).

-

List of Covered Illnesses: Ensure the policy includes illnesses relevant to your age, lifestyle, and family history.

-

Premium Affordability: Premiums increase with age; buying early saves money.

-

Waiting Period & Survival Period: Some policies require survival for 30–90 days after diagnosis to claim payout.

-

Exclusions: Understand diseases or conditions not covered, such as pre-existing illnesses or lifestyle-related conditions.

💡 Tip: Compare multiple insurers and choose one with a high claim settlement ratio and transparent terms.

6. Drawbacks to Consider

-

Additional Cost: Premiums are separate from health insurance, though generally affordable.

-

Limited Coverage: Only covers listed illnesses; not all health issues qualify.

-

Overlap with Health Insurance: Some may already have coverage through comprehensive health plans.

Critical illness insurance is not mandatory, but for high-risk individuals or those seeking extra financial security, it can be invaluable.

Critical illness insurance is not just about medical expenses; it’s about protecting your financial future and peace of mind. For individuals with dependents, high medical costs, or a history of critical illnesses in the family, this coverage can make a significant difference.

“Health crises are unpredictable, but your financial preparedness doesn’t have to be. Critical illness insurance ensures you fight the illness, not financial stress.”

Carefully assess your risk, existing insurance, and family responsibilities to decide if critical illness coverage is right for you.