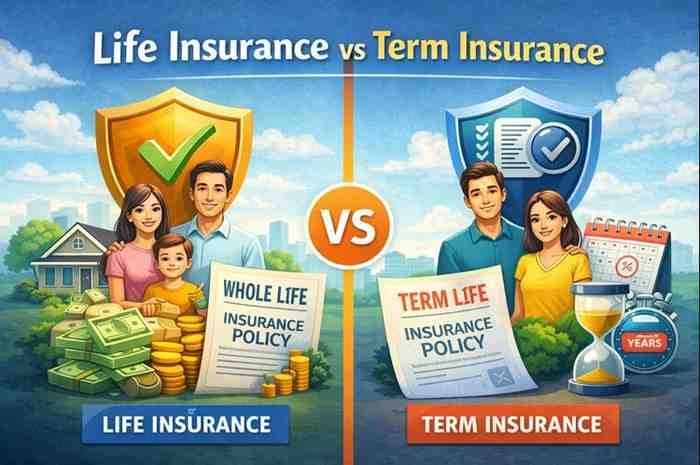

Life Insurance vs Term Insurance: Which Should You Buy?

Insurance is a crucial component of financial planning, protecting you and your family from unexpected financial hardships. However, with multiple types of insurance available, many people get confused between life insurance and term insurance. Choosing the right policy depends on your goals, financial situation, and long-term plans.

This guide explains the differences, benefits, and considerations to help you decide which insurance policy suits you best.

1. Understanding Life Insurance

Life insurance is a broad category that provides financial security to your dependents in case of your demise. It usually comes with a savings or investment component along with risk coverage.

Types of Life Insurance:

-

Whole Life Insurance: Provides coverage for your entire life with a savings component.

-

Endowment Plans: Combines insurance with savings; pays a lump sum on maturity or death.

-

Unit-Linked Insurance Plans (ULIPs): Insurance + market-linked investment.

Pros of Life Insurance:

-

Offers lifelong coverage

-

Provides maturity benefits, combining savings with insurance

-

Suitable for disciplined long-term savers

Cons:

-

Premiums are higher compared to term insurance

-

Investment returns are often lower than pure market investments

-

Complexity in understanding policy terms and charges

2. Understanding Term Insurance

Term insurance is a pure protection plan that pays a death benefit to your nominee if you pass away during the policy term. There is no maturity benefit, making it much cheaper than traditional life insurance plans.

Pros of Term Insurance:

-

Low premiums with high coverage

-

Simple to understand and manage

-

Focuses purely on protection without mixing investment

Cons:

-

No savings or maturity benefits

-

Coverage ends if the policy term expires, and renewal may be expensive

-

Not suitable for long-term investment or wealth creation

3. Key Differences Between Life Insurance and Term Insurance

| Feature | Life Insurance | Term Insurance |

|---|---|---|

| Purpose | Protection + Savings/Investment | Pure Protection |

| Premiums | Higher due to investment component | Lower and affordable |

| Maturity Benefit | Yes, often guaranteed | No |

| Flexibility | Less flexible, long-term commitment | Flexible and simple |

| Investment Returns | Low to moderate | Not applicable |

| Ideal For | Long-term savers seeking security + growth | Those seeking affordable high coverage |

4. Factors to Consider Before Choosing

-

Financial Goals:

-

If you want pure protection for dependents → Term Insurance

-

If you want savings + coverage → Life Insurance

-

-

Budget:

-

Term insurance offers higher coverage at lower cost.

-

Life insurance premiums can strain monthly finances if coverage is high.

-

-

Dependents’ Needs:

-

Evaluate your family’s current and future expenses — education, mortgage, daily living.

-

-

Investment Preference:

-

If you prefer separate investments for wealth creation, term insurance + mutual funds may be better.

-

-

Age and Health:

-

Younger and healthier individuals get lower term insurance premiums.

-

Life insurance premiums increase with age and may include investment risk.

-

5. Why Many Experts Prefer Term Insurance

For most salaried professionals and young families, term insurance is recommended due to:

-

Affordable premiums allowing high coverage

-

Simplicity and focus on protection

-

Ability to invest separately for wealth creation rather than relying on insurance returns

💡 Tip: Use term insurance to secure financial liabilities and savings/investments for goals separately.

6. When Life Insurance Makes Sense

Life insurance may suit you if:

-

You are risk-averse and prefer a guaranteed corpus

-

You want a forced savings mechanism along with protection

-

You are planning for long-term financial goals like retirement or child’s education

💡 Tip: Consider ULIPs or endowment plans only after comparing returns with alternative investment options.

7. Combination Strategy

Many financial planners suggest a combination strategy:

-

Buy a term insurance policy for high coverage and low cost

-

Use remaining funds for mutual funds, PPF, or other investments to meet wealth creation goals

-

Add a small life insurance or ULIP plan if you need guaranteed returns with coverage

This approach maximizes protection while optimizing wealth creation.

The choice between life insurance and term insurance depends on your financial goals, risk appetite, and family obligations.

“Term insurance protects your family’s future, while life insurance may help you save — choose based on what aligns best with your financial plan.”

For most young professionals and middle-class families, term insurance plus separate investments is the most effective strategy. Life insurance may be considered later if you prefer guaranteed returns along with coverage.