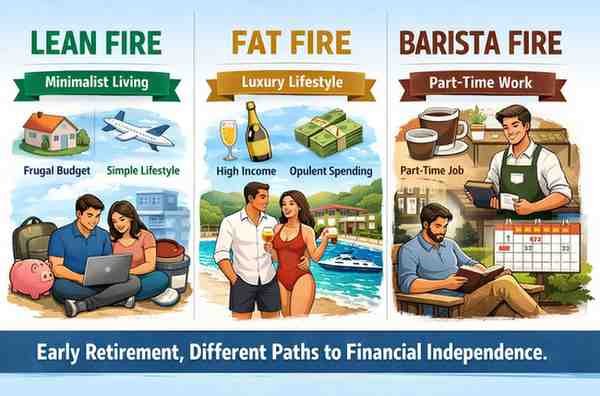

Lean FIRE vs Fat FIRE vs Barista FIRE – Which One Suits You?

The FIRE movement—Financial Independence, Retire Early—has gained massive popularity in recent years, especially among millennials and working professionals who want to escape the traditional 9-to-5 grind. But financial independence means different things to different people.

That’s why the FIRE community has evolved into multiple paths, each designed for different lifestyles, income levels, and financial goals. The three most popular types are:

-

Lean FIRE

-

Fat FIRE

-

Barista FIRE

Each offers a different approach to early retirement. In this guide, we break down what they mean, how much money you need, and how to choose the FIRE strategy that fits your life.

What Is FIRE? (Quick Overview)

FIRE is the strategy of saving and investing aggressively so you can retire decades earlier than the traditional retirement age.

The idea is simple:

-

Lower your expenses

-

Increase your savings rate

-

Invest your money in growth assets

-

Build a large enough corpus that lets you live off returns

What changes in each FIRE type is how much you save, how you live, and how early you quit working.

1. Lean FIRE – Minimalist, Low-Cost Lifestyle

Lean FIRE is the simplest and fastest way to retire early—but only if you are comfortable with minimalistic living.

✔ What It Means

You retire when you have enough money to sustain a lean, frugal lifestyle, usually on a lower monthly budget.

✔ Who It’s For

-

People who don’t mind living with fewer luxuries

-

Minimalists

-

Digital nomads living in low-cost countries

-

Individuals with low living expenses

✔ Typical Annual Expenses

₹4 lakh – ₹8 lakh per year

✔ Required Corpus

Using the 4% rule:

Annual expenses × 25

Example: If you spend ₹6 lakh per year →

₹6,00,000 × 25 = ₹1.5 crore corpus needed

✔ Pros

-

Fastest path to retirement

-

Requires smaller corpus

-

Ideal for low salary earners or frugal lifestyles

✔ Cons

-

No room for luxury spending

-

Inflation can affect sustainability

-

Unexpected expenses may hurt corpus

2. Fat FIRE – Luxury, Comfort & Financial Abundance

Fat FIRE is the premium version of retirement. It lets you maintain a comfortable, high-quality lifestyle without cutting expenses.

✔ What It Means

You retire early with a large retirement corpus that supports a more luxurious life.

✔ Who It’s For

-

High-income professionals

-

Business owners

-

People who want financial security plus lifestyle comfort

-

Families who don’t want to compromise on travel, gadgets, eating out, etc.

✔ Typical Annual Expenses

₹12 lakh – ₹30 lakh or more per year

✔ Required Corpus

Example: If you spend ₹20 lakh per year →

₹20,00,000 × 25 = ₹5 crore corpus needed

✔ Pros

-

Comfortable lifestyle even after retirement

-

No financial stress about spending

-

Better flexibility for emergencies, travel, and healthcare

✔ Cons

-

Requires high income or long working years

-

Takes more time to achieve

-

Requires disciplined investing

3. Barista FIRE – Partial Retirement With Part-Time Income

Barista FIRE is a balanced middle path.

You retire from your stressful, full-time job but continue working part-time or freelancing to cover some expenses.

✔ What It Means

You don’t need a full retirement corpus because part-time work covers a portion of your expenses.

Your investments cover the rest.

✔ Who It’s For

-

People who want a less stressful life

-

Those who can earn through freelancing or consulting

-

Individuals who enjoy working but want freedom

-

Moderate savers

✔ Typical Annual Expenses

Let’s say your lifestyle costs ₹10 lakh/year:

-

Corpus covers 50%

-

Part-time work covers the remaining 50%

✔ Required Corpus

If investments must cover ₹5 lakh annually:

₹5,00,000 × 25 = ₹1.25 crore corpus needed

✔ Pros

-

Earlier retirement

-

Less pressure to save aggressively

-

More freedom + income stability

✔ Cons

-

Still need to work part-time

-

Income may not be consistent

-

Requires skill or job options for part-time income

Side-by-Side Comparison

| Feature | Lean FIRE | Barista FIRE | Fat FIRE |

|---|---|---|---|

| Lifestyle | Minimal | Moderate | Luxurious |

| Corpus Needed | Lowest | Medium | Highest |

| Time to Achieve | Fastest | Moderate | Slowest |

| Work Needed After FIRE | None | Part-time | None |

| Ideal For | Frugal individuals | Balance seekers | High-income earners |

How to Choose the Right FIRE Strategy for You

Here’s how to decide:

1. Your Spending Style

-

Love luxuries? → Fat FIRE

-

Prefer frugal living? → Lean FIRE

-

Want moderate lifestyle? → Barista FIRE

2. Your Income Level

-

High salary/profession → Fat FIRE

-

Medium income → Barista FIRE

-

Low to medium income with low expenses → Lean FIRE

3. How Early Do You Want to Retire?

-

Want to retire in your 30s or early 40s → Lean FIRE or Barista FIRE

-

Prefer retiring in 40s or 50s with comfort → Fat FIRE

4. Your Risk Tolerance

-

Lean FIRE requires strict budgets

-

Fat FIRE requires market exposure and discipline

-

Barista FIRE reduces risk through part-time income

Conclusion

Lean FIRE, Fat FIRE, and Barista FIRE all lead to financial independence—but the lifestyle, strategy, and timeline differ for each.

✔ Choose Lean FIRE if:

You prefer simplicity and want to retire the fastest.

✔ Choose Barista FIRE if:

You want freedom from full-time work but still want income security.

✔ Choose Fat FIRE if:

You want a comfortable, luxury-rich retirement without compromises.

The best FIRE strategy is the one that matches your income, personality, lifestyle expectations, and long-term goals.