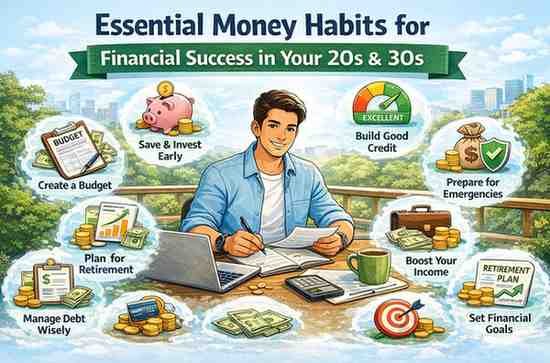

Essential Money Habits for Financial Success in Your 20s & 30s

Your 20s and 30s are the most influential decades of your financial life. These are the years when you build your career, make major life decisions, and form habits that shape your long-term wealth. If you learn the right money habits early, you can avoid years of financial stress and build a future full of freedom, stability, and opportunities.

Here are the essential money habits every young adult must build to achieve financial success.

1. Master the Art of Budgeting

A budget is not a restriction—it is your financial map.

Without knowing where your money goes, wealth building becomes guesswork.

Use the 50/30/20 rule or customise your own:

-

50% Needs: Rent, food, bills

-

30% Wants: Outings, lifestyle spending

-

20% Savings & Investments

Apps like Walnut, Money Manager, Jupiter, or Fi help automate tracking.

Good budgeting = more control + less stress.

2. Build an Emergency Fund (Your First Line of Defense)

Unexpected medical bills, job loss, or urgent home repairs can derail finances.

Aim for 3–6 months of expenses saved in:

-

A separate savings account

-

A liquid mutual fund

-

A high-interest online bank account

Start small with ₹1,000–₹2,000 per month.

Consistency matters more than amount.

3. Start Investing Early—Even Small SIPs Make a Big Difference

The earlier you invest, the more your money compounds.

Best beginner-friendly options:

-

Index Funds (Nifty 50, Sensex)

-

Equity Mutual Funds (via SIP)

-

PPF for long-term wealth

-

Gold SIPs for diversification

Even ₹500–₹2000 monthly can grow into lakhs over time.

Your 20s & 30s are the perfect time to take advantage of long-term compounding.

4. Avoid High-Interest Debt—Especially Credit Cards

Credit cards are useful only when used responsibly.

They become dangerous when treated as extra income.

To stay safe:

-

Always pay full due amount

-

Keep utilization under 30%

-

Avoid converting purchases into EMIs

-

Never carry credit card debt

High-interest loans destroy wealth faster than savings can build it.

5. Live Below Your Means (Not Below Your Happiness)

Lifestyle inflation—spending more as you earn more—kills long-term wealth.

Smart living means:

-

Spending consciously, not emotionally

-

Avoiding unnecessary upgrades (phones, cars, gadgets)

-

Choosing value over brand

-

Keeping fixed expenses low

Small lifestyle choices today create freedom tomorrow.

6. Build Multiple Income Streams

Relying on a single salary is risky in today’s economy.

Start building side incomes like:

-

Freelancing (content, design, video editing, coding)

-

Selling digital products

-

Affiliate marketing

-

YouTube, blogging, or short-form content

-

Online tutoring

-

Weekend consulting

Even an extra ₹5,000–₹20,000 per month accelerates savings and investments.

7. Protect Yourself with Insurance

Most people ignore insurance until it’s too late.

You need:

-

Term insurance (10–15x your annual income)

-

Health insurance (even if your employer provides it)

-

Accident insurance if your job involves travel

Insurance protects your finances from unexpected shocks.

8. Save for Big Goals Early

List your major financial goals:

-

Buying a home

-

Marriage expenses

-

Car purchase

-

Travel plans

-

Children’s education (if applicable)

-

Retirement

Invest for each goal separately using:

-

Equity funds for long-term goals (8+ years)

-

Hybrid or debt funds for medium-term goals

-

RDs or short-term debt funds for near-term goals

Clear goals keep you disciplined and motivated.

9. Keep Learning About Money

Financial literacy is the strongest wealth-building tool.

Read books, follow finance blogs, take courses, and track financial news.

Start with topics like:

-

Mutual funds

-

Stock market basics

-

Taxes

-

Loans & credit score

-

Budgeting & personal finance planning

Knowledge reduces fear and increases confidence.

10. Build a Strong Credit Score (CIBIL)

A good credit score helps you get:

-

Lower interest rate loans

-

Faster approvals

-

Higher credit limits

Maintain a healthy score by:

-

Paying bills on time

-

Keeping credit utilization low

-

Avoiding too many loan applications

-

Maintaining old credit accounts

Your CIBIL score can make or break future financial opportunities.

Conclusion

Financial success in your 20s and 30s isn’t about earning a huge salary—it’s about building the right habits. If you consistently budget, save, invest, and avoid debt traps, you will be miles ahead of your peers.

Start now.

Start small.

Stay consistent.

Your future self will thank you.