Personal Loans: Pros, Cons, and Alternatives

by financeretire · Published · Updated

A personal loan can be a quick financial solution when you need funds for emergencies, education, weddings, travel, or debt consolidation. It’s one of the most flexible credit options available today — but like every financial product, it has both advantages and drawbacks.

This article explores the pros, cons, and alternatives to personal loans, helping you make an informed borrowing decision.

1. What Is a Personal Loan?

A personal loan is an unsecured loan offered by banks, NBFCs, and fintech lenders. Unlike home or car loans, it doesn’t require any collateral. The borrower can use the funds for any purpose, and repayment usually happens through monthly EMIs over a fixed tenure (typically 1–5 years).

💡 Example: You can take a ₹5 lakh personal loan for 3 years to pay off credit card dues, medical bills, or wedding expenses.

2. Pros of Personal Loans

A. No Collateral Required

Since personal loans are unsecured, you don’t have to pledge assets like property, gold, or investments. This makes them accessible for salaried and self-employed individuals alike.

B. Quick Approval and Disbursal

Most lenders now offer instant approval and same-day disbursal, especially for customers with good credit scores. Fintech platforms can process loans within minutes.

C. Flexible Usage

The loan can be used for almost any purpose — from emergency expenses to business capital, home renovation, or travel.

D. Fixed EMIs and Tenure

Repayments are structured with fixed monthly EMIs, making it easier to plan your finances and avoid uncertainty.

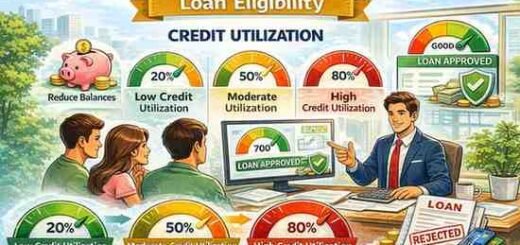

E. Opportunity to Build Credit Score

Timely repayment of EMIs can improve your credit score, enhancing future loan eligibility.

In short: Personal loans provide quick access to funds without risking assets.

3. Cons of Personal Loans

A. High Interest Rates

Since they are unsecured, interest rates are higher (typically between 10% and 24% per annum) compared to secured loans. Borrowers with low credit scores may face even higher rates.

B. Additional Fees and Charges

Processing fees, prepayment penalties, and late payment charges can increase the total cost of borrowing.

C. Shorter Repayment Tenure

Unlike home or car loans with longer repayment periods, personal loans must be repaid in 1–5 years, leading to higher EMIs.

D. Impact on Credit Score

Missed or delayed EMIs directly impact your CIBIL score, making future borrowing difficult.

E. Potential Debt Trap

Using personal loans for unnecessary expenses or taking multiple loans can lead to a cycle of debt if not managed responsibly.

Caution: Borrow only when absolutely necessary and ensure repayment capacity.

4. Alternatives to Personal Loans

Before opting for a personal loan, consider these cheaper or smarter alternatives:

A. Credit Card EMI Conversion

If you’ve made large purchases on your credit card, you can convert them into EMIs at lower interest rates than standard credit card interest.

B. Loan Against Fixed Deposit or Insurance

You can borrow against your FD or life insurance policy at lower interest rates (6–9%), while keeping your investment intact.

C. Gold Loan

A secured loan where you pledge gold ornaments. Interest rates are relatively lower (8–12%), and processing is quick.

D. Salary Advance or Employer Loan

Some companies offer salary advances or internal loan facilities at zero or minimal interest for employees in urgent need.

E. Peer-to-Peer (P2P) Lending

Online P2P platforms connect borrowers directly with investors. Interest rates can be competitive, but always check the lender’s credibility.

F. Top-Up Loan on Existing Loan

If you already have a home loan or personal loan, you can opt for a top-up instead of a new loan — often at better interest rates.

Tip: Compare the total cost and repayment flexibility of all options before choosing a personal loan.

5. When Should You Take a Personal Loan?

A personal loan can be beneficial when:

✅ You need urgent funds for genuine needs (e.g., medical emergency or debt consolidation)

✅ You have a stable income and repayment capacity

✅ You maintain a high credit score (700+) for better rates

✅ You have compared alternatives and found no cheaper options

Use personal loans as a financial tool — not as a habit for funding lifestyle expenses.

6. Smart Tips Before Applying

-

Check your credit score and improve it if necessary.

-

Compare lenders for rates, processing fees, and prepayment terms.

-

Avoid multiple loan applications at once — it lowers your credit score.

-

Borrow only what you need and ensure EMI affordability (under 30% of your income).

-

Read the fine print before signing the agreement.

7. Final Thoughts

A personal loan can be a financial lifesaver when used wisely, but a burden when misused. Its flexibility, quick approval, and no-collateral feature make it attractive — but high interest rates and short repayment tenures require disciplined financial planning.

“Borrow smart, not often. Use personal loans for financial growth — not impulse spending.”

Before applying, assess your needs, explore alternatives, and ensure you can comfortably repay the loan without affecting long-term goal.